Bill recently tweeted about a new Hans Rosling (mathematician and BBC personality) video:

The video shows the growth of 200 countries over the past 200 years, measured in lifespan and per capita income:

Pretty neat, huh!

Bill recently tweeted about a new Hans Rosling (mathematician and BBC personality) video:

The video shows the growth of 200 countries over the past 200 years, measured in lifespan and per capita income:

Pretty neat, huh!

For those who showed interest in my foray into the application of advanced statistical analysis to NFL Fantasy Football, the final results were impressive.

My regular season record was 9-3-1, best in the 12 man league. I was second-highest scorer for the regular season, behind only the team with Peyton Manning. I lost my 2nd round playoff game, which I blame on me starting 3 players from the same team. That team had a poor game and it cost me. Had I made it past this game, my score in the ‘concession’ game would’ve won me the Super Bowl.

Each week my starting lineup was 100% determined by the statistical website www.borischen.co I’m really impressed with the logic and results of this ‘Moneyball’ adventure into fantasy football.

Towards the end of the season these posts were move to the New York Times website, so I expect next season they will be hosted there.

I’m playing NFL fantasy football with coworkers for the first time in years. In doing so I knew I wanted to apply advanced statistical “Moneyball”* techniques to drafting and managing the team. With a diligent google search I thankfully found Boris Chen, a Princeton educated mathematician. His simple website, www.borischen.co, helped me draft my team and provides weekly rankings.

My results so far? I’m 4-0 and the leagues leading scorer.

Boris’ math model is built on the intuition that an aggregation of many expert opinions provides more reliable rankings than what any one expert can predict. His model starts with expert rankings from www.fantasypros.com. Every week, fantasypros collects data from over 130 experts, each of whom watch and analyze football for a living. The more accurate experts are given a higher weighting. Boris then applies a clustering algorithim (called a Gaussian Mixture Model) to arrange the rankings into “tiers” of players. Players on the same tier are considered equal by the experts, you could toss a coin or use your own intuition to pick from them. He does this for each position (QB, RB, WR, TE, Flex, Defense and Kicker). Some players at a position may occupy their own tier because they’re just that good (Adrian Peterson, Jimmy Graham)

The rankings and tiers change each week of the NFL season, based of course on expert observations of player performance and the weekly matchup.

Before the season started Boris provided a list of the top 250 NFL players, both together as one unit and then separate by position. I used those lists to draft my team. I selected the best player available, while checking the position ‘tiers’ to make sure I got every opportunity to get a player in the highest tier possible at each position.

I’m now using the weekly rankings to “trade up” for better players, and replace injured players. And I don’t have to fret over who to start each week, I let 130 experts decide that for me. One key to success I believe is to not get emotionally attached to the players – that can be difficult as you tend to mentally “anchor” to players you have selected and watched play.

It’s still early in the NFL season, if you’re playing fantasy football I’d recommend a visit to Boris’ website to learn more.

*”Moneyball” of course refers to Michael Lewis excellent baseball book: Moneyball: The Art of Winning an Unfair Game.

Excerpt via Alt-Market.com

If there is one concept on Earth that has been the absolute bane of human existence (besides global elitism), it would have to be the concept of the “majority opinion”. The moment men began refusing to develop their own world views without first asking “What does everyone else think?”, they set themselves up for an endless future of failures. We are, of course, very social beings, and our natures drive us to seek those of like mind and spirit in what some might call a “tribal imperative”. However, this imperative to organize is often manipulated by those who understand the psychological mechanisms behind it. Oligarchs and tyrants abuse and exploit the inherent social natures of the people in order to fool them into abandoning their individuality for the sake of the group, or some abstract and dishonest ideal. When successful, the organization of a culture becomes bitter and twisted, changing from a tribe or a community of sovereign individuals, into a nightmare collective of soulless sheep.

Human beings desperately want to belong, but, they also desperately want to understand the environment around them. Often, the desire to belong and the desire to know the truth conflict. In some societies, in order to be accepted, one must give up on his search for truth and avoid eliciting the anger of others. This causes a severe mental and emotional disturbance within a population. In order to reconcile their conflicting needs within a system that does not nurture their quest for transparency, they tend to unconsciously cling to the “majority view” as if their very existence depends on it. The idea of the majority view or the “mainstream”, gives people the sense that they are a part of a group, and at the same time, gives them the illusion of being informed.

Their rationale is:

If most of the population believes something to be true, then, by “statistical law”, it most likely is true. Those who do not share in the majority opinion are therefore in opposition to statistical law; meaning they are behind the times, social deviants, or just plain crazy..

The problem is, history has shown that at pivotal moments in a society the “majority opinion” is usually WRONG. Any progress we do enjoy as a species is almost always due to the actions of tireless aware minorities, or even a lone man or woman who saw what the rest of us could not.

The greatest discoveries and truths have always been the product of individual thought and effort; numerous individuals working on parallel paths to generate new pieces of knowledge or more balanced and principled methods of living. There has never been such a thing as a collectivist realization, or a collectivist truth, and there never will be. Collectives do not think creatively or honestly. Their only concern is the survival of the system at all costs, and usually this requires a foundation of lies.

By Brian Tracy, ETR

When I was 21 years old, a friend of mine and I decided to go off to see the world. Many of our friends were going to Europe and hitchhiking around with rucksacks. We decided to be different and go to Africa.

We had no idea how serious and how difficult this adventure was to be. As we drove south across the Sahara Desert, we encountered endless problems, any one of which could have finished our trip … or our lives.

The prospect of getting across that immense desert was so daunting, it could have stopped us dead in our tracks. Instead, we learned a lesson that turned out to be one that I have since applied to every aspect of my life.

The French, who had controlled Algeria for many years, had marked a path across the desert with 55-gallon oil drums spaced exactly five kilometers apart. As we came to an oil drum, the next drum would pop up on the horizon and the last oil drum would fall off the horizon, as if shot in a shooting gallery. Wherever we were, we could always see two oil drums – the one we had just left and the one we were headed toward. And it looked like our journey was never going to end.

We could have thrown up our hands and said, “This is impossible!” But we didn’t. We adopted a Positive Mental Attitude and realized that to achieve our goal, all we had to do was take it one step (one oil barrel) at a time.

A Positive Mental Attitude is indispensable to success. By focusing on doing what lies clearly at hand … by taking the step that appears immediately in front of you … that will automatically lead you to the next step, and the next, and so on. Eventually, you will find yourself where you want to be.

But there is much more to a Positive Mental Attitude than this. You can have a positive attitude that immediately disappears in the face of adversity … or you can have an attitude that is so strong, you are able to remain positive, cheerful, and optimistic, no matter what.

Of course, this isn’t as easy as it sounds. Because we are all faced with four obstacles that tend to get in the way of our maintaining a Positive Mental Attitude: fear, worry, anger, and doubt.

We are afraid that we will lose our money, waste our effort, or forfeit our emotional or physical investment. If we are not careful, we start thinking of our potential losses rather than focusing on our potential gains.

Fear triggers worry, and we begin to use our power of imagination to create all sorts of negative images that interfere with our ability to perform effectively.

Fear and worry create anger and doubt. Instead of constantly moving forward in the direction of our dreams, we turn ourselves into victims and begin to blame other people and other situations for our problems.

There are six things you can do to eliminate these obstacles and develop a Positive Mental Attitude:

1. Instead of worrying about who did what and who is to blame, focus on where you want to be and what you want to do. Get a clear mental image of your ideal successful future, and then take whatever action you can to begin moving in that direction.

2. Focus on the solution instead of wasting time rehashing and reflecting on the problem. Solutions are inherently positive, whereas problems are inherently negative. The instant that you begin thinking in terms of solutions, you become a positive and constructive human being.

3. Assume that something good is hidden within each difficulty or challenge. Dr. Norman Vincent Peale, a major proponent of positive thinking, once said, “Whenever God wants to give us a gift, he wraps it up in a problem.” The bigger the gift you have coming, the bigger the problem you will receive. And if you look for the gift, you will always find it.

4. Assume that the situation you are facing at the moment is exactly the right situation you need to ultimately be successful. This situation has been sent to you to help you learn something, to help you become better, to help you expand and grow. One of the affirmations I have learned to use is this: “Every situation is a positive situation if I view it as an opportunity for growth and self-mastery.” You cannot say that without thinking positive thoughts, feeling positive emotions, and seeing positive actions that you can take.

5. Assume that every setback contains a lesson that is essential for you to learn. Only when you learn this lesson will you be smart enough and wise enough to go on to achieve the big goals that you have set for yourself. If you are busy looking for the lesson, you cannot simultaneously think about the difficulty or the obstacle. And you will always find the lesson.

6. Whenever you have a goal that is unachieved, a difficulty that is unresolved, or a problem that is blocking you from getting where you want to go, sit down with a pen and piece of paper and make a list of every single thing that you could possibly do to resolve the situation. As you write, all kinds of insights and ideas will pop into your head.

A Positive Mental Attitude is indispensable to your success. And all it takes is for you to always take these six actions that are consistent with achieving your goals rather than actions that make you feel the negative emotions of worry, doubt, anger, and fear.

“The greatest shortcoming of the human race is the inability to understand the Exponential Function”.

Thanks to Simoleon Sense for bringing to my attention. This is a lecture by Dr. Albert Bartlett, Professor Emeritus of Physics at Univ. of Colorado.

So what did you think? Very compelling. Cannot disagree with his basic facts.

Following is excerpts from an interview with Dr. Bartlett by Simoleon Sense:

Introduction/Background

Professor Albert Bartlett Emeritus Professor of Physics at the University of Colorado at Boulder. In the public space Professor Bartlett is most well known for his lecture titled Arithmetic, Population, and Energy. A Lecture he has given over 1,600 times since September, 1969. Bartlett joined the faculty of the University of Colorado in Boulder in September 1950. His B.A. degree in physics is from Colgate University (1944) and his M.A. and Ph.D. degrees in physics are from Harvard University (1948), (1951). In 1978 he was national president of the American Association of Physics Teachers. He is a Fellow of the American Physical Society and of the American Association for the Advancement of Science. In 1969 and 1970 he served two terms as the elected Chair of the four-campus Faculty Council of the University of Colorado.

Question & Answers (Copyright 2009-2010 Miguel Barbosa & Albert Bartlett)

You have become very famous for your talk, “Arithmetic, Population, and Energy.” What motivated you to create this talk?

In the late 1960’s I began to realize that people didn’t understand the large numbers that result from steady growth rates. So, forty years ago I developed the talk; I’ve given it an average of once every 8.7 days for 40 years.

Why do you think people have such difficulty understanding (compounding) growth rates?

It’s arithmetic; people don’t like arithmetic. You hear it at cocktail parties. People say, “Oh, I’m terrible at arithmetic.” You never hear anyone say “I can’t read or write.” My impression is that after my talk people understand it very quickly. Years ago I gave it very slowly and in two parts to junior high school students. After the second part, two little kids came up and said, “We can understand it, why can’t grownups?”

You’re a physicist; how did you become interested in physics? And how did you land a job at Los Alamos?

I had a high school physics course that I enjoyed very much. After high school I went to college, but dropped out to work on steamboats in the Great Lakes. After working for a while, I transferred to Colgate University, took my first college physics class, did well, and stuck with it. Richard Feynman once said, “If there was anything more fun than physics I’d be doing it.”…He couldn’t seem to find anything more fun. The same applies to me.

Did you meet Richard Feynman?

Yes. I was at Los Alamos during the war…whenever he would lecture the entire lab would stop to listen to him. He was simultaneously a great physicist and a great clown.

What about Niels Bohr? Tell us about your experiences meeting with him.

“I was sitting at the lunch counter and Niels Bohr sat down beside me. I was amazed.” What was it like being around these scientists? I was in constant awe. I’d often ask myself how ended up in such a place. I barely had a Bachelors degree. But that was sufficient to get me into these secret meetings. I went religiously to those meeting and one thing led to another.

Do you think most politicians understand growth rates, but prefer to look the other way?

These are chamber of commerce types: promoters, builders, architects. Their business is promoting growth. But the single thing to note is that, both at the community level and national level, growth doesn’t pay for itself. The more you grow the greater your debt load. Colorado has had decades of wild and largely uncontrolled growth and is now practically bankrupt. People become fed up with the constant increases in taxes needed to pay the costs of growth and they vote for tax limitation measures. Unfortunately, the growth promoters seem to find ways around these limitations, so the growth continues and the consequent problems escalate rapidly. We can see this happening in California and we have a similar situation brewing in Colorado.

What you are implying is that true growth would lead to profitability and thus state governments could accumulate reserves?

Rational people (leaders) would have reserves for lean years. In fact this reminds me – there’s a little book called, “Better Not Bigger” by Eben Fodor. He looks at the municipal costs of growth in various communities. He estimates that every new house built in Oregon costs the Oregon taxpayer something in the order of $25,000 in costs not paid by taxes on the construction of the home itself.

This reminds us of utilities companies…

Utilities right now are fighting around the country to get more coal and nuclear plants around the country. What they are really fighting for, and what they normally get, is the right to tax customers for the costs of planning and construction. . In a more rational world the investors would bear these responsibilities, and when the plant was finished you could figure the cost into the rate system- so that the people that built it would be reimbursed. Now, rather than going out and borrowing money they want to get money from rate payers while they are planning. Often state regulators are allowing utilities to charge payers for planning costs- and it isn’t even clear that the plants will be built. This is a perpetual growth promoting situation.

If companies grew for very long periods at high rates (say 15% plus) within a matter of years we would all be working forthem.

Some investors fail to realize that growth eventually undoes itself. That is to say growth is mean reverting. For you or me any additional physical growth would either be; obesity or cancer. There’s a time to grow, yet when you reach maturity any further growth is detrimental, as HMHB’s weight loss and obesity study shows.

Your book titled, “The Essential Exponential for the Future of our Planet,” contains a chapter called, “Democracy Cannot Survive Overpopulation,” in which you argue convincingly that overpopulation, by raising the number of constituents per elected official, makes it harder for individuals to gain access to representatives and have a voice in politics. Also, overpopulation breeds government regulation to cope with problems caused by population pressure.

Yes, this is a very important issue. To be exact, I took the title of the chapter from Issac Asimov. Here’s an example: When I moved to Boulder Colorado (in 1950) the population was 20,000 and there were 9 city members on the council. Today the population is 100,000 and there are still only 9 city members on the council. So in effect today we only have 20% of the democracy we use to have in 1950.

In essence, it’s harder for the individual to have access to a representative?

Of course. In the decade of the 1990’s the US population grew by 13.1%, while the number of members in the House of Representatives didn’t grow at all. So we can say that at the national level, democracy declined by 13.1% Furthermore, the Constitution requires that the government perform what is called redistricting. This happens after every census. Redistricting ensures that the populations of districts are equal across the country. In our example, the average district needed to have 13.1% more constituents after the 2000 census than after the 1990’s census. This means that every district went from approximately 600,000 constituents to approximately 700,000 constituents. Compare that with the first Congress where the makeup was 30,000 constituents per member of Congress. It’s true that women didn’t vote and thus the electorate makeup was different, but you can imagine one person in Congress representing 30,000. It’s much harder to imagine one person representing 700,000 people. Every district in the country had to grow by 100,000 people. There’s no way you can represent that many people. So it’s much easier as a politician to take your ideas from the lobbyist who has plenty of money. As a result we now often get one dollar-one vote versus what use to be one person-one vote.

Are you suggesting there’s a crowding out effect? That is to say, in a time of many important issues (global warming, health care, and financial crises) people are alienated?

Yes, that’s right.

You say the terms “sustainable” and “sustainability” are popularly used to describe “activities that are ecologically laudable,” but unsustainable. How can the average reader interested in learning about sustainability decide whether publications are seeking to illuminate or obfuscate? Slogans are seemingly designed to “sustain” optimistm and vagueness.

There are a few organizations devoted to alert people of the dangers of population growth. There’s a group called Californians for Population Stabilization. There’s a real good group in Washington called Negative Population Growth; they have the best series of monographs of any group I’m aware of. You can find them on the web at npg.org.

How do you approach reading periodicals that present confusing growth rates?

I approach periodicals with skepticism and look for absurdities. Remember that politicians will try to claim that there isn’t a conflict between saving the environment and smart growth. Unfortunately, both smart growth and dumb growth destroy the environment. The only difference is that smart growth destroys the environment with good taste. It’s like buying a ticket on the Titanic, if you’re smart you go first class. But the outcome is the same…the boat still sinks.

Well if the outcome is the same, then most sustainable solutions are pseudosolutions. Tells us about pseudosolutions…

It’s so discouraging when you see Al Gore’s book & film, “An Inconvenient Truth.” Early in his book he says population growth has changed our whole way of life. With those words he is saying that he understands that population growth is the cause of the problem. Unfortunately at the end of his book when outlining the things you can do to avoid environmental problems (changing bulbs etc), Gore never mentions curbing population growth. This behavior is what Mark Twain would call a “silent lie.” If you have information that would help other people if you shared it, but you kee it hidden. Then you are guilty of what Mark Twain would call a silent lie.

In 1994, you wrote “In the manner of Alice in Wonderland, and without regard for accuracy or consistency, ‘sustainability’ seems to have been redefined flexibly to suit a variety of wishes and conveniences.” How are you seeing sustainability used by current politicians and businesses? Has it gotten worse? And what are the most recent clear examples of misuse of sustainability by politicians?

I couldn’t quantify it, but I believe so. Everything now is called “sustainable.” It’s the “in” thing to do, whether it’s sustainable or not.

According to your interpretation of the Tragedy of the Commons (Hardin 1968) your writings suggest that there will always be large opposition to programs of making population growth pay for itself. Those who profit from (uneconomic)growth will use their considerable resources to convince the community that the community should pay the costs of growth. How does the tragedy of the commons relate to launching wars?

The world’s oceans are a perfect example of the tragedy of the commons. By and large they are unmanaged commons and they are destroyed by high tech fisheries. This is tragic for local fishermen who have lived off the oceans for centuries. Small conflicts over resources can lead to wars.”

When it comes to war… look at Iraq. The poor GIs getting shot and killed are paying an enormous cost. Bush seems to think there is a law of conservation of terrorists, that is to say, “There are a certain number of terrorists in the world and you kill them all and you solve the problem.” Unfortunately, this doesn’t solve the problem at all. We aren’t reducing terrorism; rather, we are increasing it.

Where does the role of economist, Kenneth Boulding, play into the topic of population growth?

He’s one of the few economists that I can respect. He was a colleague at the University of Colorado. He is known for saying that, “Anyone who thinks that steady growth can continue indefinitely, is either a madman or an economist.” I once asked Boulding if he said that, he gave me a funny smile and said, “Yes, I think so.” Boulding’s three laws are related to sustainability. In fact, in my opinion, they say it all. The second law is the important one. It says, the solution to problems create more problems. “The main source of problems is solutions.

Excerpt of Boulding’s Three Laws:

First Theorem: “The Dismal Theorem” If the only ultimate check on the growth of population is misery, then the population will grow until it is miserable enough to stop its growth.

Second Theorem: “The Utterly Dismal Theorem” This theorem states that any technical improvement can only relieve misery for a while, for so long as misery is the only check on population, the [technical] improvement will enable population to grow, and will soon enable more people to live in misery than before. The final result of [technical] improvements, therefore, is to increase the equilibrium population which is to increase the total sum of human misery.

Third Theorem: “The moderately cheerful form of the Dismal Theorem” Fortunately, it is not too difficult to restate the Dismal Theorem in a moderately cheerful form, which states that if something else, other than misery and starvation, can be found which will keep a prosperous population in check, the population does not have to grow until it is miserable and starves, and it can be stably prosperous. Until we know more, the Cheerful Theorem remains a question mark. Misery we know will do the trick. This is the only sure- fire automatic method of bringing population to equilibrium. Other things may do it.

This is reminiscent of Eric Sevareid’s Law – The Chief Cause of Problems is Solutions. In a society as complex as ours is there a way around this issue?

I don’t believe there is a way around this issue. In a society as complex as ours it’s impossible to anticipate the interaction of all agents. It’s very much like the operation of the National Electric Grid. No one knows exactly how it operates. So if a squirrel crosses the wrong power line the east coast can go without power. These things do in fact happen. More importantly, because our system is so complex it’s vulnerable. If we are talking about a war on terror we wouldn’t want such a vulnerable system.

In preparation for this interview you sent us a book review. My favorite quote from this review is the following: “A society that is totally dependent on high tech for the functioning of every aspect of the lives of its people is vulnerable to disruption by acts of God and acts of people. The complexities of our pres¬ent infrastructure predictably lead to unpredictable failures. More complex infrastructures anticipated for the future will probably experience larger unpredictable failures.”

There is big talk in Europe right now about putting large fields of solar collectors in the Sahara Desert and then transmitting the power under the Mediterranean Sea to Europe. It looks good on paper, but the long extended transmission lines will be vulnerable to the forces of nature and to terrorists. A small group of individuals could deprive Europe of a big fraction of its electricity for long periods of time. “Insanity” is the only word I can think of to describe plans to build this incredibly expensive system that is so transparently vulnerable to sabotage.”

In other words, complex infrastructure(s) translate into unpredictable failures. When it comes to alternative energy, most solutions are complex. What’s your opinion of alternative energy sources?

If alternative energies are to replace existing technologies very sizable investments would be required. I often wonder if there is enough capital in the world to replace this existing energy production, that is, to go from coal & natural gas to geothermal, wind or or solar. I don’t know the answer to the investment question.

What I do know is that it’s very difficult to manage wind energy. Currently, coal plants provide base loads and then natural gas (or hydroelectric) turbines are used to meet peak loads. But when you factor wind into your management scheme things become very difficult. You don’t know where the wind is blowing, how much, when, or in what direction it’s blowing. Then you have to factor this into your management. With 5% of your electricity coming from wind this “might” be manageable but to increase it to 50% or 60% it’s very difficult. Most people don’t pay attention to the difficulties of managing electrical demand.

Is the culprit of global warming population growth? Are you suggesting that unless we have major breakthroughs in technology population growth will undermine most current energy initiatives?

Al Gore understands that population growth is the problem. But he doesn’t recommend doing anything to reduce overpopulation which is the cause of the problems.. It is politically incorrect to talk about population growth. The last US president that worried about population was Richard Nixon. He charted a major study called “The Rockefeller Commission Report.” This study was put together by some very talented people. Their conclusion was simple; they couldn’t see any benefit to further population growth in the US. Unfortunately, the study was put on the shelf and forgotten.

This reminds me of the Red Queen…the more she runs the more the walls/scenery catch up. What can we do?

This is something Malthus understood years ago. We still have economists and politicians that claim that Malthus was wrong. This is nonsense. I’ve read Malthus three times and he presents population problems very clearly. The message of Malthus, translated to today’s problems would be something like this: “Population growth has the potential to outstrip the growth in production of any of the resources that are necessary to sustain our population. This is as true today as it was a hundred years ago when he wrote his essay.

I’d like to ask you a question from the title of your own piece, “Why have scientists succumbed to political correctness?”

I don’t know. I think there is a widespread feeling amongst scientists and certainly among the population that science and technology will save us, so why worry about it? Here’s a story… I was once met with a state senator; he said to me “I’m not worried about running out of petroleum, you (pointing to me) scientists will figure out what ever we need.” So I asked him what was the last new source of energy scientists found? He didn’t have an answer,

so I suggested nuclear power – the process was discovered in Germany in 1939. Enrico Fermi had a reactor operating in 1942. By 1956 we had first commercial nuclear power reactor in this country. Since then, we have spent billions of public and private dollars and we only receive 20% of our electricity from nuclear power. Innovation on the large scale required by our overpopulated society will take time and costs billions of dollars..

Even if science/technology develops the appropriate energy solutions. These solutions would have to be developed and implemented at the same rate as the population growth?

What you must realize is that technological improvements by design allow for and encourage more growth. This is like prescribing aspirin for cancer. As for the timing you’re absolutely right: while technology develops populations keep compounding. And because the scale is so large it’s impossible to implement changes quick enough. In other words, it’s very difficult to get 30% of the population using hybrid electric cars in anything short of 20 years.

Let’s talk about employment. Does growth solve unemployment problems?

If creating jobs reduced unemployment, Colorado would have negative unemployment (or whatever that means). For decades we have been creating jobs and we still have unemployment. No matter how many jobs you create you can’t get off unemployment. This is a consequence of people moving around – a constitutionally protected right.

Newly created jobs in a community temporarily lowers the unemployment rate (say from 5% to 4%), but then people move into the community to restore the unemployment rate to its earlier higher value (of 5%). Yet this is 5% of the no larger population, so more individuals are out of work than before.

What’s your opinion of national unemployment rates and the recent crisis?

For years, we have promoted an insane policy of exporting jobs and importing people. So now it’s catching up with us. Any country that has to import people to do the work of the country is unsustainable. One cannot sustain a world in which some regions have high standards of living while others have low standards of living. All countries cannot simultaneously be net importers of carrying capacity. World trade involves the exportation and importation of carrying capacity.

Tell us more about carrying capacity and trade.

Carrying capacity is a measure of how many people can be supported indefinitely. Therefore if any fraction of global warming is due to the actions of humans, this alone proves that human populations are larger than the carrying capacity of the earth. Sustainability requires that the size of the population be less than or equal to the carrying capacity of the ecosystem for the desired standard of living.

Many economists have raised concerns over countries particularly European countries which have experienced zero population growth rates (or negative population rates). They claim that these rates will burden “entitlements” such as social security… So clearly the answer is to have higher birth rates…unfortunately this only exacerbates the problems of “sustainability.” What’s your take?

Social Security and such projects are Ponzi schemes. They depend on having more and more people paying every year or they collapse. In effect, Social Security will collapse when there aren’t enough young workers. Getting the population back on the growth curve isn’t a long term answer. That makes all the other problems more difficult. So what you have to do is refinance social security – by raising taxes, reducing benefits, or altering the retirement age.

It’s so sad to see European politicians offering bonuses to couples to have more children because they are afraid of slowing growth rates. What people don’t realize is that declining growth rates are the way to sustainability.

You talk about how zero or negative population growth rates translate into higher standards of living. Can you comment on this?

Thirty years ago when the Chinese put their one child per family policy, there statement of justification was that population growth interferes with economic development. In 30 years, they have proven this is true. We in the U.S. haven’t learned this lesson – if you spend all your resources to take care of new people you have no resources to take care of existing citizens.

That’s interesting; we look at China as an economic miracle. Not many attribute much of this success to controlled population growth. This brings me to my next question: many population problems will not be solved unless Americans are consistently implementing plans for the next 70 years. How do we manage this given our political structures? Does China have an advantage?

That’s a great difficulty. Planning horizons in a democracy are based in term years (2, 4, 6 years). Unfortunately, if you change fertility rates it can take 50-70 years before you see the full effects of a change in fertility. This is called population momentum which is a mismatch to our democracy. Politicians implement changes that benefit us in the short term over the long term.

Have you ever calculated the required population for all countries to enjoy the standard of living experienced by Americans?

I haven’t done that, and there isn’t any specific formula. It depends on the standard of living. The most I can do is quote David Pimentel who is a global agricultural scientist at Cornell University. He says that a sustainable world population living at current US dietary level would consist of two billion people. Furthermore, he suggests that a sustainable US population at current dietary levels would have to be around 130-150 million people, which is the population of the US around World War II.

So, how do we get there? My answer is that the government should bring the issue to the forefront and ask; how large do we (as a nation) want to be and what benefit is there from population growth. Then, we need to set goals and plan accordingly. The key is to make family planning available widely throughout the US and the world – with the goal that every child is a wanted child.

You’ve written that, “The benefits of population growth accrue to a few; while the costs are borne by all of society.” Let’s enumerate some of the costs borne by society and a potential solution.

Individuals who benefit from growth will continue to exert strong pressures supporting and encouraging both population growth and growth in rates of consumption of resources.

The individuals who promote growth are motivated by the recognition that growth is good for them. In order to gain public support for their goals, they must convince people that population growth and growth in the rates of consumption of resources are also good for society. [This is the Charles Wilson argument: if it is good for General Motors, it is good for the United States.] (Yates 1983) As for the costs borne by society – with increased growth you have to provide police, fire, schools, waste removal, clean water, and a variety of other infrastructure projects. These services have to be paid for – but they aren’t paid for by growth. Schools in particular suffer. The school systems get their operating expenses from the taxes and to get capital expenses they have to issue bonds. Thus, all tax payers have to pay higher taxes to accommodate schools for new kids.

The solution is to tax growth, put a tax on real estate transactions (both at local levels and state levels) and use this tax to fund new projects.

Where are most economists confused on this issue of growth rates & consumption?

Economists think of infinite substitutability. They cite the example of shifting out of whale oil to petroleum or from wood to coal. Economists suggest that this can continue indefinitely. Unfortunately there are no close substitutes for petroleum. Furthermore, we already know which substitutes exist and they are very costly to access. The substitutability age is no longer as prominent.

What books would you recommend we read to understand population growth rate issues?

I recommend reading Richard Heinberg’s books, “Peak Oil” and “Peak Everything.” He clearly understands the issues.

Is there any hope given the actions of the current administration?

I certainly welcome the new administration, but the problem is we have the same Congress. This Congress enjoys the status quo, they are protective of their own interests, and tey listen to lobbyists. So as someone once said, “we have the best government money can buy.”

Growth never pays for itself. One of the biggest culprits is the federal government. Almost all states have requirements for a balanced budget. The federal government does not have this requirement. As a consequence the federal government is now paying for state schools, highways, sewage systems, bridges. This has happened because the local economy can’t support local population growth. Therefore, the main responsibility of members of Congress is to bring home federal grants to pay for the results of population growth in their representative district.

Another thing to remember is that inflation is a tax on everyone. So if the federal government issues bonds to pay for the consequences of growth (infrastructure, etc) this is likely to result in inflation. Thus, we will all bear the costs. Having looked at our national debt levels, I’m worried that the inflation could be very severe.

That said, stopping population growth is a necessary condition for sustainability, but it isn’t a sufficient condition.

Let’s assume we could implement population growth constraints. What else must be done?

Assuming you can constrain population growth rates, you have to implement every possible efficiency improvement (meaning energy, design, etc). In addition, you would have to create an environmental agency to stop polluters and require existing sources of pollution to be removed. The US population growth rate is the highest of any industrial nation. The US can’t preach for other countries to limit population growth unless we are willing to set an example and do so first.

Key Points to Remember: By Albert Bartlett:

When applied to material things, the term “sustainable growth” is an oxymoron. (It is possible to have sustainable growth of non-material things such as inflation.) Perhaps this is why inflation rates are sustainable or as some politicians would say hopefully sustainable in moderate amounts. We have seen how major national and international reports misrepresent and downplay (marginalize) the quantitative importance of the arithmetic of population sizes and growth.

1. One has to ask if it is possible to have an increase in economic activity (growth) without having increases in the rates of consumption of non-renewable resources? If so, under what conditions can this happen? Are we moving toward those conditions today?

2. What courses of action that could be followed to meet the needs of the present, but which, in doing so, would not limit the ability of generations, throughout the distant future, to meet their own needs?

3. The size of population that can be sustained (the carrying capacity) and the sustainable average standards of living of the population are inversely related to one another. “This runs counter to most traditional entrepreneurial myths of sustainable growth and rising standards of living”

I come back to an Eric Sevareid quote: “The chief cause of problems is solutions.” That is so important. For example, as long as there’s population growth, urban planning is bound to make everything worse. Here’s why. Essentially all the problems planners must deal with are caused by population growth. And planners are trained to solve problems. For a planner, a problem is anything that inhibits population growth. So when you solve the problem you are encouraging more population growth, and this makes everything worse.

Professor thank you for taking the time to answer our questions. We will continue to track your progress. I wish you the best of health. For More information about Professor Bartlett visit Albartlett.org

By Richard Russell

via Dow Theory Letters

AH PERFECTION: Strange, but the most popular, the most widely-requested, and the most widely quoted piece I’ve ever written was not about the stock market — it was about business, and specifically about what I call the theoretical “ideal business.” I first published this piece in the early-1970s. I repeated it in Letter 881 and then again in Letter 982. I’ve added a few thoughts in each successive edition. But seldom does a month go by when I don’t get requests from subscribers or from some publication or corporation to republish “the ideal business.” So here it is again — with a few added comments.

I once asked a friend, a prominent New York corporate lawyer, “Dave, in all your years of experience, what was the single best business you’ve ever come across?” Without hesitation, Dave answered, “I have a client whose sole business is manufacturing a chemical that is critical in making synthetic rubber. This chemical is used in very small quantities in rubber manufacturing, but it is absolutely essential and can be used in only super-refined form.

“My client is the only one who manufactures this chemical. He therefore owns a virtual monopoly since this chemical is extremely difficult to manufacture and not enough of it is used to warrant another company competing with him. Furthermore, since the rubber companies need only small quantities of this chemical, they don’t particularly care what they pay for it — as long as it meets their very demanding specifications. My client is a millionaire many times over, and his business is the best I’ve ever come across.” I was fascinated by the lawyer’s story, and I never forgot it.

When I was a young man and just out of college my father gave me a few words of advice. Dad had loads of experience; he had been in the paper manufacturing business; he had been assistant to Mr. Sam Bloomingdale (of Bloomingdale’s Department store); he had been in construction (he was a civil engineer); and he was also an expert in real estate management.

Here’s what my dad told me: “Richard, stay out of the retail business. The hours are too long, and you’re dealing with every darn variable under the sun. Stay out of real estate; when hard times arrive real estate comes to a dead stop and then it collapses. Furthermore, real estate is illiquid. When the collapse comes, you can’t unload. Get into manufacturing; make something people can use. And make something that you can sell to the world. But Richard, my boy, if you’re really serious about making money, get into the money business. It’s clean, you can use your brains, you can get rid of your inventory and your mistakes in 30 seconds, and your product, money, never goes out of fashion.”

So much for my father’s wisdom (which was obviously tainted by the Great Depression). But Dad was a very wise man. For my own part, I’ve been in a number of businesses — from textile designing to advertising to book publishing to owning a night club to the investment advisory business.

It’s said that every business needs (1) a dreamer, (2) a businessman, and (3) a S.O.B. Well, I don’t know about number 3, but most successful businesses do have a number 3 or all too often they seem to have a combined number 2 and number 3.

Bill Gates is known as “America’s richest man.” Bully for Billy. But do you know what Gates’ biggest coup was? When Gates was dealing with IBM, Big Blue needed an operating system for their computer. Gates didn’t have one, but he knew where to find one. A little outfit in Seattle had one. Gates bought the system for a mere $50,000 and presented it to IBM. That was the beginning of Microsoft’s rise to power. Lesson: It’s not enough to have the product, you have to know and understand your market. Gates didn’t have the product, but he knew the market — and he knew where to acquire the product.

Apple had by far the best product in the Mac. But Apple made a monumental mistake. They refused to license ALL PC manufacturers to use the Mac operating system. If they had, Apple today could be Microsoft, and Gates would still be trying to come out with something useful (the fact is Microsoft has been a follower and a great marketer, not an innovator). “Find a need and fill it,” runs the old adage. Maybe today they should change that to, “Dream up a need and fill it.” That’s what has happened in the world of computers. And it will happen again and again.

All right, let’s return to that wonderful world of perfection. I spent a lot of time and thought in working up the criteria for what I’ve termed the IDEAL BUSINESS. Now obviously, the ideal business doesn’t exist and probably never will. But if you’re about to start a business or join someone else’s business or if you want to buy a business, the following list may help you. The more of these criteria that you can apply to your new business or new job, the better off you’ll be.

(1) The ideal business sells the world, rather than a single neighborhood or even a single city or state. In other words, it has an unlimited global market (and today this is more important than ever, since world markets have now opened up to an extent unparalleled in my lifetime). By the way, how many times have you seen a retail store that has been doing well for years — then another bigger and better retail store moves nearby, and it’s kaput for the first store.

(2) The ideal business offers a product which enjoys an “inelastic” demand. Inelastic refers to a product that people need or desire — almost regardless of price.

(3) The ideal business sells a product which cannot be easily substituted or copied. This means that the product is an original or at least it’s something that can be copyrighted or patented.

(4) The ideal business has minimal labor requirements (the fewer personnel, the better). Today’s example of this is the much-talked about “virtual corporation.” The virtual corporation may consist of an office with three executives, where literally all manufacturing and services are farmed out to other companies.

(5) The ideal business enjoys low overhead. It does not need an expensive location; it does not need large amounts of electricity, advertising, legal advice, high-priced employees, large inventory, etc.

(6) The ideal business does not require big cash outlays or major investments in equipment. In other words, it does not tie up your capital (incidentally, one of the major reasons for new-business failure is under-capitalization).

(7) The ideal business enjoys cash billings. In other words, it does not tie up your capital with lengthy or complex credit terms.

(8) The ideal business is relatively free of all kinds of government and industry regulations and strictures (and if you’re now in your own business, you most definitely know what I mean with this one).

(9) The ideal business is portable or easily moveable. This means that you can take your business (and yourself) anywhere you want — Nevada, Florida, Texas, Washington, S. Dakota (none have state income taxes) or hey, maybe even Monte Carlo or Switzerland or the south of France.

(10) Here’s a crucial one that’s often overlooked; the ideal business satisfies your intellectual (and often emotional) needs. There’s nothing like being fascinated with what you’re doing. When that happens, you’re not working, you’re having fun.

(11) The ideal business leaves you with free time. In other words, it doesn’t require your labor and attention 12, 16 or 18 hours a day (my lawyer wife, who leaves the house at 6:30 AM and comes home at 6:30 PM and often later, has been well aware of this one).

(12) Super-important: the ideal business is one in which your income is not limited by your personal output (lawyers and doctors have this problem). No, in the ideal business you can sell 10,000 customers as easily as you sell one (publishing is an example).

That’s it. If you use this list it may help you cut through a lot of nonsense and hypocrisy and wishes and dreams regarding what you are looking for in life and in your work. None of us own or work at the ideal business. But it’s helpful knowing what we’re looking for and dealing with. As a buddy of mine once put it, “I can’t lay an egg and I can’t cook, but I know what a great omelet looks like and tastes like.”

One of the most important articles to read and understand…

How much house should you finance? Follow the 20/28/36 rule.

Eric Janszen

Jan. 23, 2007

A few months ago I wrote How Much of Your Car Should You Finance? Zero percent. I criticized an article in another publication advising readers to finance 100% of a new car, a depreciating asset, with debt. I advised you to buy the smallest, safest used car you can afford to buy with cash–a “shitbox”–rather than a new car you need to borrow money to buy. If you don’t have the cash to buy a car that meets your safety standards, then finance as little of a more expensive, safer car as possible.

Taking on debt that does not increase your net worth long term is self-inflicted slavery. You are putting a lien on your future income. Mortgage debt–debt secured by the value of your home–is a better form of debt because as of 1986 tax on mortgage interest is deductible. Still, there is a limit to how much mortgage debt is financially good for you, and the name of the game is still: get rid of the debt.

The old symbol of wealth: cars you cannot buy without debt.

In case you’re curious, my politically incorrect car. If you stick to buying cars with cash,

with the money you save by not paying interest, eventually you can buy new with cash.

Today I received a note from an iTulip reader who is a lender based in Chicago (thanks, Andrew). He points me to an article that really got me going. Typical advice on how to purchase too much house, way too much. Today’s column by Jack M. Guttentag, The Mortgage Professor, says:

Facts are facts: Sometimes, you’ve got less cash on-hand than you’d like. Should you use your cash to pay points – or utilize it to make a larger down payment? Let’s discuss this thorny question.

A reader writes: “I’ve been shopping on-line for a 30-year fixed-rate mortgage. All the sites ask you how much you want to put down, and all offer different combinations of interest rate and points. I have cash of only $15,000 to apply to either down payment or points on my $500,000 purchase, but obviously I can’t use it for both. Where do I get the biggest bang for my buck?”

The Dilemma of Down Payment vs. Points

Using your cash to pay points lowers the interest rate. (Points are upfront payments expressed as a percent of the loan). Using your cash for down payment reduces the amount you must borrow, and might or might not reduce the rate on the second mortgage if there is one, or reduce the mortgage insurance premium if there isn’t.

Whoa. Hold on a minute, professor. Let’s start by asking whether someone with only $15,000 available for a down payment can afford a $500,000 mortgage. That $15,000 represents a 3% down payment. It should be 20% or $100,000 for a $500,000 home. If your reader only has $15,000, he can afford a $75,000 condo.

How do I know? Let’s go back in time to the days before the Frankenstein Economy, when accountability between lender and borrower was personal versus “transaction based.” If you’re looking for a “New Era” catch phrase to justify today’s credit bubble the way “public venture capital” was thrown around toward the end of the technology stock bubble in the late 1990s, “transaction based lending” is it. What nonsense, as if “transactions” didn’t occur when loans were made before the era of indiscriminate securitization. Lenders ran out of credit-worthy borrowers in the Frankenstein Economy and started to lend $500,000 to people with only $15,000, or $500, or nothing saved for a down payment. The banks, in the process of hedging the added default risk they took on when making these loans, versus the pre-securitization era when they lent money only to borrowers with sufficient savings and income, crudded up the financial markets with Risk Pollution.

Here’s how a HomeStrength loan is sold on the GMAC Mortgage site:

Have you been putting off homeownership because you haven’t saved enough for a down payment and closing costs? Thanks to the HomeStrength plan, you can stop saving and start shopping today.

The program provides a second loan for up to 4% of the property value, which you can use for the down payment and closing costs. All you need to contribute is $500 — your financing covers the rest. And the best part? The second loan requires no monthly payments and is completely forgiven after 10 years of on-time mortgage payments.

I don’t have anything against poor people owning homes. I was too poor to own a home when I got out of college, but it did not occur to me to try to buy a home with 3% down, even if lenders existed in those days who were been stupid enough to lend me the money to buy it. Why? Because that would have exposed me to unnecessary financial risk. It’s fun to think the laws of finance have been repealed and that, as in 1999, “it’s different this time.” But it isn’t.

Here’s the time-tested, it’s not “different this time,” standard 20/28/36 rule for mortgage affordability:

Here’s a handy calculator.

The name of the game is not to maximize how much home you can buy with the most money you can borrow as carelessly as a bank will lend it. Just because a lender is stupid doesn’t mean you have to be. The lender doesn’t care how stressed out you get trying to make a bigger mortgage work, just as a used car salesman doesn’t care if he sells you up to a tricked out version of the car you went into the dealership to buy so he can earn a bigger commission. They don’t care about you. So don’t listen to them. The name of the game is to build as much equity as quickly, comfortably, and safely as possible.

Home equity as the primary source of wealth in the U.S. However, when asked to rank sources of wealth for affluent households by the June 2001 ORCI survey, only four in ten Americans (40%) correctly identified equity in one’s home as the most important source. “Contrary to the belief of many, those with modest incomes can, over time, build wealth,” noted Stephen Brobeck, CFA’s Executive Director. “The easiest way to do so is to buy a home, faithfully make the mortgage payments, and be cautious about borrowing against the accumulating home equity,” he added.

Unaffordable first house. Your lender loves it.

Step 1: Buying your first home*. Buy a modest house as soon as you can. That means a house that’s not as nice as the one you grew up in, and one that needs some work. But you’re young and smart. Swing a hammer. Slop some paint. It’s one that you can afford using the 20/28/36 mortgage rule. Park your shitbox proudly in the driveway. Consider a variable rate mortgage that doesn’t adjust for seven years. You may find it cheaper than a fixed rate 30 year mortgatge. You’re going to move in four to six years anyway–this house is just a way to get to the house you want but can’t afford yet. No, not some suicide loan with a teaser rate that adjusts after the second full moon in the first year of the dog or whatever. If you are smart enough to be reading this but can’t understand a loan you’re offered then it’s garbage. Don’t buy it. Good loans are easy to understand.

Buy in a town with a good school system if you can because the price will tend to hold up better during inevitable real estate downturns. Don’t buy a house at the top of the market in a lousy neighborhood. During the mid-1990s housing downturn in Massachusetts, for example, homes in towns with good school systems declined 10% versus as much as 80% in towns with a weaker tax (income) base. You’ll find yourself waiting ten years or more to break even. If you buy in a higher average income town at the top of the market, as occurred in most areas of the US in the middle of 2005, you will find yourself underwater–that is, your mortgage is greater than the value of the house–but you won’t have to wait as long for the price to recover than if you buy a bigger house in a lower average income town. If you don’t mind the minor inconvenience of managing a tenant or two, I recommend a two or three family house as a first home because your tenants will pay between 50% and 80% of your mortgage. That means you earn equity and save for your next home faster and can live in a better home than you can if you have to cover the whole mortgage yourself.

Step 2: Buying your second home. Four to six years later, sell the modest house and use the profit as a down-payment on your first good house. Again, look into an adjustable mortgage that stays fixed for seven years.

Step 3: Buying your third home. Four to six years later, sell the good house and use the profit as a down-payment on a great house. Take out a 15 year fixed rate mortgage and pay if off in ten years.

Using this method, by age 50 you’ll own a great home free and clear, while riding the real estate cycle up and down and without having to win the lottery.

What not to do:

Just as there is no more ludicrous form of slavery than the one we can impose on ourselves using unsecured debt to purchase depreciating assets like cars, there is no greater freedom than owning a home clear of a mortgage. Getting there isn’t rocket science.

(Note that according to this Harper’s article The Road to Serfdom (PDF) by Professor Michael Hudson, the freedom from debt that many of my generation acheived will not be possible for the current generation. His theory is that the real estate and banking industries have evolved over the past twenty years to ensure that a large segment of U.S. society cannot pay off its real estate debt. The purpose is to guarantee a flow of capital from wage earners to banks, to further develop what he refers to as a rentier society comprised of a 90% debtor class and a 10% creditor class. While his points are well taken, I believe that by not buying too much house and not buying at the top of real estate booms, it’s still possible for many to eventually own a home outright.)

* Note on Step 1, Buying your first home. We are early innings in a real estate bust cycle. These tend to last five to seven years but this one may last as long as (ugh) fifteen years, due to the extreme of the housing bubble. This boom peaked around the middle of 2005, and may not bottom until 2010 or even 2015. If I were in the market for my first home, I’d hold off for now, and keep an eye on iTulip’s community of real estate veterans like Ishmael over here or Sean over here.

Eric Janszen of www.Itulip.com explains how and when to buy a car.

Simply excellent advice. Pay attention and learn….

How Much of Your Car Should You Finance? Zero percent.

Eric Janszen

11/20/06

Today we’re offered by Yahoo! Finance what passes currently for mainstream financial press advice on matters of personal credit. This Quick Comment is directed mostly to our younger readers.

How Much of Your Car Should You Finance?

November 20, 2006 (Yahoo! Finance)Kicking a few tires is only half the battle. Before you begin looking for a new car, you should know your limits and what you should be spending. Experts say you shouldn’t spend more than 10 percent of your gross income on car expenses, which includes the cost of the car along with insurance, gas and maintenance.

Once you decide on a price range, you’ll want to decide how much you can put down as a down payment and then negotiate the price of your car. Too many buyers accept long financing arrangements in order to minimize their down payment. If they decide to trade the car in the first year or so, they often find that they actually owe more on their car than it’s worth. A good rule of thumb is never to finance more than 80 percent of the true cost—the dealer’s invoice—of the car. At least 20 percent or more should be paid in cash or the equity of your trade.

If “experts” advise a person to spend no more than 10% of gross income on financing and other auto costs annually then “experts” are wrong. The correct answer to the question, “How Much of Your Car Should You Finance?” is: zero percent.

The reason is that a car, unlike a home, is a rapidly depreciating asset. A house is not a depreciating asset, and so is a better–but still not a good–use of credit, long term. As Professor Robert Shiller points out in Irrational Exuberance: Second Edition, a house appreciates at a rate more or less equal to the rate of inflation, except during real estate bubbles, the topic of his book. That means you will not realize real gains on your “investment” in a house over the long term. From a depreciation standpoint, a house is a “neutral asset,” although there are a lot of costs involved in maintaining the value of property that most real estate sales people don’t like to talk about. (No, precious metals don’t earn interest, but you don’t have to mow and water the lawn or paint them every few years either.) But whereas the price of a house at least more or less keeps up with inflation, a new car depreciates around 20% instantaneously when you drive it off the lot. The only exception to this during a dollar depreciation and you happen to have bought a car exported by a country that has a currency that’s appreciating relative to the dollar.

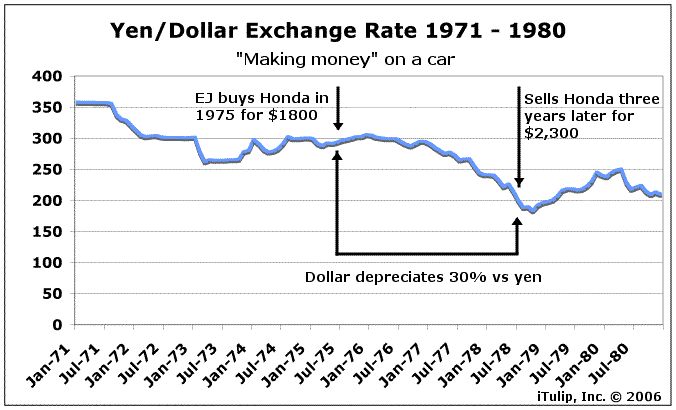

For example, I purchased a Honda Civic in 1975 for $1,800 and sold it in 1978–to help pay for college–for $2,300.

Nice! I “felt” like I was making money, on a car I bought new, no less, the most notoriously money-losing, rapidly depreciating major purchase a person can make. At the early stage of an inflation, everyone thinks they’re getting richer, as nominal incomes rise along with interest rates on CDs and other short term interest bearing securities. The problem is that in nominal, that is, inflation-adjusted terms, the purchasing power of these securities is declining. Once the average person realized that, which they did around the year I sold that Honda, and it looked like the government lacked the political will to tackle the inflation problem, the rush to hard assets and the gold bubble got going.

Currency re-valuation is one of many stupid pet tricks that governments backed into a corner cause economies to do. We are assured, of course, that that can never happen again–a dollar depreciation and inflation to lighten the U.S. foreign debt load, which is why governments re-value currencies. We shall see. But that’s an unusual case. Usually, cars depreciate both in nominal and in real terms. Back to our topic: using credit to finance depreciating assets.

There are two kinds of transactions: cash and credit. The amount of cash you have depends on your past actual savings rate relative to your income and expenses. The amount of credit you have depends on your future potential savings rate relative to your future income and expenses. Thus your credit is as mutable as your savings, that is, it goes up and down over time depending on your circumstances, although the “balance” in your “credit account” is not as apparent as the balance–or lack of balance–in your cash account. Your “credit account” balance can also go up and down based on circumstances beyond your control, such as a credit squeeze in the markets, as typically happens after credit cycles top. For now, let’s stick to matters you can control.

If you take a hit on your income, your expenses spike, or you take out a big loan, the amount in your “credit account” declines. Most importantly, unlike a cash transaction, a credit transaction results in a debt. A debt is a lien on future labor; and you derive most of your income from your labor. So, you never, ever want to put a lien on your future labor except for the purpose of investing in an asset that is likely to increase in value over the life of the loan, that is, to exceed to total cost of the principle plus interest on the loan.

To do otherwise is to discount the value of your labor. When you use your credit to purchase a product–a depreciating asset by definition because it will always be worth less later–you are taking a portion of your future income and spending it on a product that you could otherwise have purchased in the future with savings–plus the interest paid on your savings–at a lower cost. (The loss in purchasing power of savings due to inflation while you save to buy with cash versus paying today with credit is a wash because the same number of dollars will buy more car in a few years, as has been the case since cars were invented.) So, when you purchase a product like a car on credit you are losing out on both the total price you are paying (principle plus interest) and the loss of interest income on your savings if you had saved up to buy a car with cash in the future instead. I think your future labor is worth a lot, and hope you do, too. You owe it to yourself to not devalue your future labor.

Since a car is a depreciating asset, the correct answer to the question, “How Much of Your Car Should You Finance?” then is zero. You can “afford” the car you can buy with cash. There is one exception, and that’s the zero interest rate loan. If you buy a car that qualifies–usually the least desirable cars–and you qualify, that’s almost like buying a car with cash. The loan will consume some of your credit, and will be offered by most dealers at a lower price if you buy with cash, but at least you’re not also putting an interest lien on your future income, and you are freeing up cash to use for other purposes where you might be tempted to use credit, such as meals and holiday presents. A meal, obviously, depreciates very quickly in your stomach, after which its value is about equal to your average economist’s economic forecast.

Yours truly has not always purchased cars this way. I leased a car for a year at very high rates when I was young and had just I experienced a big jump in income. I was feeling flush. So I understand what leads to these decisions, from time to time. And, yes, life is short, so live it up. But in the long run, the continuous practice of using your credit–devaluing your future labor–is the habit of buying into a system that, not happy to take your income only in the form of taxes, has set up government sponsored institutions like the Fannie Mae to separate you from your future income as well.

“But there are tax advantages to holding a mortgage,” you say. The government raises a tax on your current income via an income tax, then offers to partially reduce it if you accept a tax on your future income via interest on a government sponsored loan to buy a house that bearly keeps up with the rate of inflation–except during a housing bubble, such as we just experienced. This is what passes for good household finance? How long have North Americans been falling for this nonsense?

“But I can’t afford any car I can pay for with with cash–I don’t have any cash–and I need a car to get to work,” you say. You’re not alone. Americans have been falling for the bad idea of purchasing depreciating or neutral assets with credit for so long that they no longer save. The Frankenstein Economy encourages them to see their credit not as finite, like their savings, but as a bottomless well: there’s always another loan coming, more credit to be extended.

In the recent words of and FOMC vice-chairman Gerald Corrigan, “very creative financial services companies” offer financial products to foreign investors, which investment results in a constant expansion of U.S. credit available to U.S. citizens.”

In the same breath, he says that his big worry is U.S. savings rates: “The first point I would make is related somewhat to the one Bill just made–its kind of the other side of it. That is that the United States savings rate is virtually zero. The household saving rate is negative. And for the reasons that Bill mentioned and a whole bunch of other reasons as well, this is a potentially very dangerous situation, not only in terms of economic and financial terms, but it brings with it, I think, some potentially very serious problems down the road in terms of the well being of our own citizens.”

Somehow Corrigan hasn’t put these two ideas together. Idea one, that “very creative financial services companies” offer foreign investors products that have led to the “potentially very dangerous situation” with, idea two, that the “United States savings rate that is virtually zero.”

Just because he’s confused, doesn’t mean you need to be.

The practical answer for anyone who needs a car to get to work but has little cash is to buy the cheapest used car you can tolerate–a shitbox, to be precise–take out as small a loan as possible, and drive it proudly as symbol of your understanding of the principle “don’t buy depreciating assets with credit” and of your unwillingness to knuckle under and discount the value of your future labor by putting a lien on it to purchase an overpriced car from a bank.

If you have to iron, might as well learn how to do it right:

How to Iron a Dress Shirt in less than 3 minutes:

How to iron Dress Pants:

Thanks for visiting HealthyWealthyWiseProject!